Associated: These calculators also support rule-of 78s loans and they are much more aspect rich likewise. As an example, with several you may established the dates and/or add more payments.

Usually you would probably set the "Payment System" to "Arrears" for just a loan. This means that the monies are lent on in the future and the first payment isn't due until finally a single period of time once the cash are acquired.

Even if you don’t intend to repay your loan early, it’s normally a good idea to understand how your loan curiosity is calculated if you alter your repayment technique.

The Rule of 78 is a standard system for payout charge card credit card debt. It’s a kind of accelerated payment, in which you fork out more money upfront to reduce the interest you’ll accrue in excess of the life of the loan. For illustration, In case you have $1,000 in bank card debt at twenty% APR, under the Rule of 78 you would probably fork out an extra $78 in the to start with payment. This rule is employed by lenders because it ends in them producing more money in interest payments All round.

This may be disadvantageous for borrowers who need to repay the loan early, as they will shell out a bigger percentage of the whole interest prices previously than if that they had had a traditional loan.

3. Opportunity cost savings: In some instances, precomputed interest may result in possible savings for borrowers. For the reason that fascination is calculated upfront, borrowers who repay their loans early can be entitled to the rebate to the curiosity which has been precomputed for the remaining loan time period.

On the subject of loans, comprehending the terms and conditions is critical to stop any economical pitfalls. A person component That always confuses borrowers is precomputed interest. This is where the website Rule of seventy eight arrives into Participate in.

Furthermore, this rule is usually handy for borrowers who strategy to help keep their loans for the complete time period, mainly because it permits predictable interest payments through the loan's length.

Precomputed desire is a method utilized by lenders to work out the desire on the loan. Unlike basic interest, the place desire is calculated depending on the fantastic principal harmony, precomputed fascination is decided determined by the overall degree of the loan, like the two the principal as well as the curiosity.

Hence, borrowers could locate it demanding to adjust their repayment tactic or help save on desire expenses.

It assumes that borrowers pays off additional desire in the early months of your loan time period and fewer in the later on months. This process is commonly useful for loans with fastened repayment terms, such as motor vehicle loans or individual loans.

In basic conditions, the Rule of 78 calculates a borrower’s curiosity obligation for each and every month by assigning a body weight to on a monthly basis from the loan expression. The weights are depending on the remaining balance of your loan at each month, and the sooner months have a better fat.

This can be a disadvantage for borrowers who want to help you save on interest by creating more payments or having to pay from the loan early.

In regards to loan repayment, being familiar with how desire is calculated is crucial. One usually utilised strategy would be the Rule of 78, that is a calculation approach that decides the amount desire you pays around the class within your loan.

Alisan Porter Then & Now!

Alisan Porter Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Barbara Eden Then & Now!

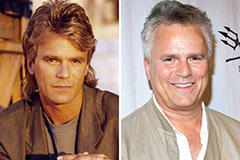

Barbara Eden Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!